In the fast-paced world of mortgage brokerage, managing multiple client inquiries, loan applications, and regulatory deadlines can be overwhelming. The complexities of the mortgage industry necessitate a robust CRM system that can centralize client data, automate tasks, and provide real-time insights. A well-selected CRM empowers brokers to manage their workload effectively and focus on building lasting client relationships.

Toc

Today’s competitive landscape makes the best CRM for mortgage brokers an essential tool rather than a luxury. A specialized CRM can streamline operations, enhance client relationships, and ultimately drive higher sales. This article will guide you through the unique challenges faced by mortgage brokers, essential features to look for in a CRM, top software options available in the market, and actionable tips for making the right choice.

Why a Mortgage CRM is Crucial for Brokers

Mortgage brokers encounter a distinct set of challenges that necessitate the use of a tailored CRM solution. Here are some compelling reasons why a dedicated CRM is essential:

Streamlined Operations: Automating Tasks for Efficiency

A specialized CRM can automate repetitive tasks, manage workflows, and improve efficiency. For instance, a mortgage broker can automate the sending of personalized email sequences to leads who express interest in a particular loan product. This can include follow-up emails with relevant information, loan calculators, and testimonials. Furthermore, integrating the CRM with a loan origination system (LOS) can automate data transfer between the two platforms, reducing manual data entry and potential errors. While some brokers may argue that manual processes allow for more personalized interactions and a deeper understanding of client needs, this can be addressed by implementing automation for repetitive tasks while still allowing for personalized touches during critical stages of the loan process.

Enhanced Client Relationships

A CRM (Customer Relationship Management) system significantly enhances client engagement by providing personalized service and effectively managing all client interactions. This tailored approach not only fosters trust and loyalty but also facilitates stronger connections between brokers and their clients. In the mortgage industry, where relationships are key to success, this level of personalized attention can lead to repeat business and referrals, helping brokers build a robust client base over time.

Improved Compliance

Navigating the ever-evolving landscape of compliance regulations can be daunting for mortgage brokers, as failure to comply can result in serious legal repercussions and financial penalties. A mortgage-specific CRM is designed to help brokers stay compliant by ensuring secure document storage, maintaining detailed audit trails, and sending timely compliance alerts. This proactive approach minimizes the risk of penalties and helps brokers focus on their core services, thereby contributing to a smoother, more efficient workflow that keeps business operations running smoothly.

Data-Driven Insights

The most effective CRMs come equipped with a powerful analytics dashboard that provides valuable insights into sales trends, customer behavior, and overall operational efficiency. By analyzing this data, brokers can identify patterns and areas for improvement, allowing them to pivot their strategies in real time to better meet client needs. This data-driven approach not only enhances decision-making but also empowers brokers to tailor their services and marketing efforts, ultimately leading to increased client satisfaction and business growth.

Essential Features of the Best CRM for Mortgage Brokers

When searching for the best CRM for mortgage brokers, it’s important to evaluate the following key features:

Contact Management

A centralized database is crucial for storing client contact details, loan information, and communication history. This feature keeps your business organized and ensures that no detail is overlooked.

Loan Document Management

A robust CRM acts as a secure vault for all your client documents, ensuring that important information is readily accessible and protected. Efficient document management is vital in the mortgage process, allowing for secure uploading, storage, and management of essential client documents, significantly streamlining the lending process.

Workflow Automation

Automation capabilities help eliminate repetitive tasks, such as client onboarding and follow-up communications. This not only saves time but also reduces the risk of human error.

Lead Generation and Management

The best CRM for mortgage brokers should provide robust tools for capturing, tracking, and nurturing leads from various sources, including website inquiries and referrals. A healthy pipeline is essential for sustained growth.

Communication Tools

Integrated communication features, including email, SMS, and video calls, enable efficient client engagement throughout the lending journey. This ensures timely follow-ups and enhances overall client satisfaction.

Compliance Management

Compliance features are critical in the mortgage industry. A dedicated CRM should offer tools for document retention, compliance alerts, and detailed reporting to help brokers stay compliant with industry regulations.

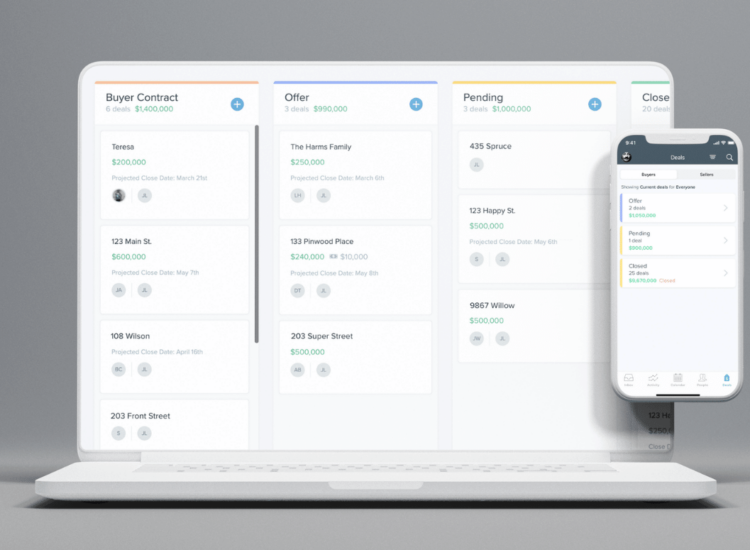

Loan Pipeline Tracking

Visualization of the loan pipeline, including the status of applications and pending tasks, allows brokers to monitor progress and quickly identify any bottlenecks in the process.

1. https://cafekinhdoanh.net/archive/3419/

2. https://cafekinhdoanh.net/archive/3415/

3. https://cafekinhdoanh.net/archive/3420/

Reporting and Analytics

Customizable reports that track key performance indicators (KPIs) can provide insights into business performance and help brokers make data-driven decisions.

Integration Capabilities

To maximize the benefits of a CRM, it’s crucial to ensure seamless integration with other software systems that are essential for mortgage brokers, such as loan origination systems (LOS), accounting software, and marketing automation platforms. This capability streamlines operations and enhances productivity.

Mobile Accessibility

Mobile access to CRM features allows loan officers to manage client relationships and tasks on the go. This flexibility is essential for brokers who are often out in the field.

Customization Options

Customizable fields, workflows, and user permissions ensure that the CRM aligns with the unique needs and processes of your brokerage.

Task Management

Effective task management tools for assigning, tracking, and prioritizing tasks related to client interactions and compliance requirements help keep teams organized and accountable.

Calendar and Appointment Scheduling

Integrated calendar features enhance productivity by allowing brokers to schedule appointments, meetings, and follow-up tasks efficiently.

Client Portal

A secure client portal enables clients to access their loan applications, upload documents, and track progress. This transparency improves the overall customer experience.

Marketing Tools

The best CRM for mortgage brokers should include features for creating and managing automated marketing campaigns, nurturing leads, and maintaining communication with past clients. This capability boosts business development efforts.

Top Mortgage CRM Software Options

As you explore the landscape of CRM solutions, consider the following standout options tailored for mortgage brokers:

Jungo

Jungo, powered by Salesforce, is a widely recognized CRM in the mortgage industry known for its comprehensive suite of tools and features. Its strengths include robust marketing capabilities, such as advanced email and video marketing tools that allow mortgage professionals to create targeted campaigns and engage clients effectively. Additionally, Jungo offers a concierge program designed to enhance client relationships after loan closings, ensuring that clients feel valued and supported throughout their journey. The platform also integrates seamlessly with leading loan origination systems like Encompass and Calyx Point, making it easier for users to manage their workflows and data without interruption.

Aidium (formerly Whiteboard)

Aidium is a modern and user-friendly mortgage CRM that provides a cost-effective alternative to more complex legacy solutions often found in the market. It excels in offering a simplified platform with mortgage-specific marketing playbooks and automation tools that streamline operations for brokers. Users can benefit from easy-to-use features that help track leads, manage client communications, and automate follow-ups, all while maintaining a focus on user experience. This makes Aidium an ideal choice for those looking to enhance productivity without the steep learning curve associated with more traditional CRM systems.

Content Snare

While not a traditional CRM, Content Snare specializes in simplifying the document collection process for mortgage brokers, a crucial aspect of the lending process. It allows users to create tailored questionnaires that fit their specific needs, facilitating the collection of necessary documentation from clients. Additionally, Content Snare automates client reminders, thus accelerating the lending application process and reducing the administrative burden on brokers. By streamlining this often tedious task, Content Snare helps brokers focus more on building relationships and closing deals.

Other Popular Options

Several reputable CRM platforms also cater to mortgage brokers, including Salesforce, Zoho CRM, and HubSpot CRM. Each of these solutions offers unique features that can benefit different brokerage needs, from advanced analytics to customizable workflows. Salesforce, for instance, is known for its extensive customization options, while Zoho CRM offers impressive affordability and integration possibilities. HubSpot CRM stands out with its user-friendly interface and powerful marketing tools, making it a favorite among smaller brokerages looking to maximize their reach.

Factors to Consider

When evaluating CRM options, consider factors such as pricing, features, integration capabilities, and customer support. Assess the specific needs of your brokerage, including scalability for future growth and the ease of onboarding new team members. The right choice will align with your brokerage’s specific requirements and budget, ensuring that you have the tools necessary to thrive in a competitive market. It’s advisable to take advantage of free trials or demos whenever available, allowing your team to explore the platform’s functionalities firsthand before making a commitment.

Tips for Choosing the Right CRM

To ensure you select the best CRM for mortgage brokers, follow these actionable tips:

Define Your Needs

Begin by identifying your specific requirements for a Customer Relationship Management (CRM) system. List out the features that are most crucial for your business operations, such as lead management, customer tracking, and reporting capabilities. Prioritizing these features will not only help streamline your selection process but also ensure that the CRM aligns perfectly with your business goals and workflow.

1. https://cafekinhdoanh.net/archive/3415/

2. https://cafekinhdoanh.net/archive/3418/

3. https://cafekinhdoanh.net/archive/3416/

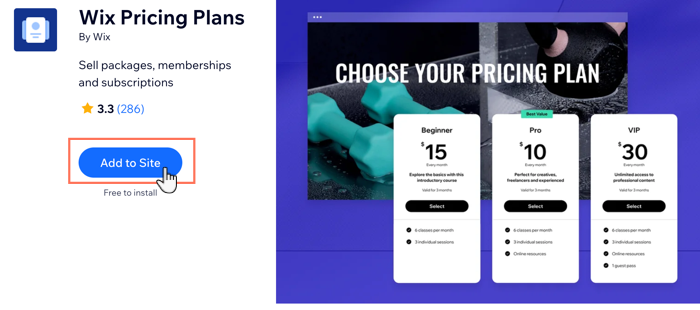

Consider Your Budget

When evaluating CRM options, it’s essential to look closely at the pricing plans and potential long-term costs associated with each solution. While finding an affordable option is important, remember that the cheapest choice may not always provide the necessary functionality. Assess the scalability of the CRM to ensure it can grow with your business, accommodating increasing data and user requirements over time.

Evaluate Integrations

A key aspect to consider is the CRM’s ability to integrate seamlessly with your existing software systems. Check if it can connect with tools you already use, such as your loan origination system, accounting software, and marketing platforms. Smooth integration is crucial for maintaining efficient workflows, reducing data silos, and enhancing productivity across your organization.

Read Reviews

Conduct thorough research by reading user reviews and testimonials on reputable platforms like Capterra, G2, and Trustpilot. These insights can provide valuable perspectives on the CRM’s usability, customer support quality, and overall performance. Pay attention to both positive and negative feedback to get a well-rounded view of potential options.

Try Free Trials

Many CRM providers offer free trials, which can be a great way to test the software firsthand without any financial commitment. Take the time to explore its features and user interface during the trial period. This hands-on experience will enable you to assess whether the CRM meets your brokerage’s specific needs and helps you envision how it can fit into your daily operations.

Frequently Asked Questions

Q1: What are the key differences between a CRM and an LOS?

A CRM (Customer Relationship Management) system focuses on managing front-end operations like lead generation and client communication, while a Loan Origination System (LOS) handles back-end loan processing from application to closing. Both systems serve different but complementary functions in the mortgage industry.

Q2: Can a CRM help me improve my compliance with mortgage regulations?

Absolutely! A mortgage-specific CRM can enhance compliance efforts by providing features such as automated compliance alerts, secure document storage, and detailed reporting to keep you updated with industry regulations.

Q3: How can I integrate my CRM with my existing marketing automation tools?

Robust CRM platforms often offer extensive integration capabilities, allowing you to connect with various marketing automation tools. This integration ensures a consistent, data-driven approach to client engagement.

Q4: What are some common mistakes to avoid when choosing a CRM?

Common pitfalls include failing to define specific needs, underestimating the importance of integration capabilities, and neglecting the CRM’s compliance features. It’s crucial to consider long-term costs and to utilize free trials for firsthand experience.

Q5: Is there a CRM that is specifically designed for small mortgage brokerages?

Yes, several CRM solutions cater to smaller mortgage brokerages. Aidium is known for its user-friendly interface and cost-effectiveness, while platforms like Zoho CRM offer affordable plans with reasonable customization options.

Conclusion

Investing in the best CRM for mortgage brokers can significantly enhance your operations, improve client relationships, and help you close more deals. By understanding the essential features, exploring top CRM solutions, and following the tips outlined in this guide, you can confidently select the best CRM for your brokerage. Consider your specific needs, budget, and integration requirements to find the perfect solution that will empower your success in the ever-evolving mortgage landscape.